Short Answer: Yes. You can deduct many professional development expenses; like courses, books, paid podcasts, conferences, workshops, and memberships – IF they directly improve the skills you already use in your business. These costs count as business expenses for 1099 workers and reduce your taxable income. Just make sure they relate to your current work, not a new career.

What does that mean for you?

If you’re a freelancer, creator, real estate pro, or any flavor of 1099 rebel, there’s a good chance you’ve spent real money learning how to get better at what you do; courses, conferences, books, memberships, maybe even a masterclass.

Here’s the good news: a lot of those professional development costs are tax-deductible – and most people never claim them.

What Counts as Professional Development?

The IRS actually wants you to stay good at your job. They allow deductions for expenses that:

- Maintain or improve the skills you use in your business

- Are directly related to the work you already do

- Are ordinary and necessary for your specific industry

In human language –

If a training, book, or resource helps you perform your business better, it probably counts.

Examples of Deductible Professional Development

Here’s where people get surprised:

Online Courses & Masterclasses

Anything that improves the skills you use to earn money:

- Skillshare, Udemy, Coursera courses

- Photography workshops

- Real estate CE courses

- Coding bootcamps

- Marketing, freelancing, or business growth trainings

If it helps you produce, sell, or manage your work better, it’s generally deductible.

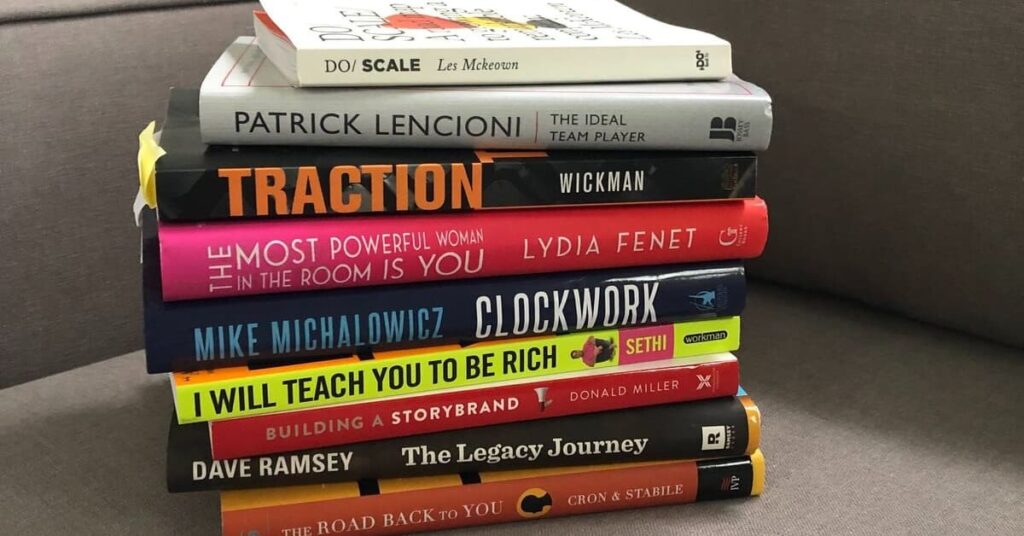

Books (Physical, eBooks, Audiobooks)

Books that help you run or grow your business count, including:

- Sales and marketing books

- Industry-specific manuals

- Productivity or business strategy books

- Technical guides

- Professional biographies relevant to your field

Your BookTok impulse purchases? Probably not. Your “How to Build a Freelance Business” audiobook? Absolutely.

Podcasts and Streaming Education

Surprise: you can deduct paid professional podcasts or audio subscriptions if they relate to your business.

Examples:

- Premium membership podcasts

- Paid educational audio programs

- Business or industry-specific podcast subscriptions

Free podcasts aren’t deductible (because… well… free).

Conferences, Seminars, Workshops

This includes:

- Tickets

- Event materials

- Required books/workbooks

- Relevant session add-ons

Travel to conferences is deductible too (different category, but still a win).

Memberships & Subscriptions

If they help you stay sharp, connected, or compliant:

- Industry associations

- Continuing education platforms

- Paid newsletters for your field

- Trade journals

- Professional tool subscriptions with training content

What Doesn’t Count?

Professional development that:

- Trains you for a new career

- Is unrelated to your current 1099 work

- Is more “personal growth” than business development

A yoga retreat to “find clarity”? Probably not.

A webinar on how to market your Etsy store? Yes.

A 3-month ceramics course when you’re a real estate agent? Fun, but… no.

How to Claim These Deductions

You’ll categorize them as business expenses, usually under “Education and Training.”

To make it audit-proof:

- Keep receipts

- Save course descriptions

- Screenshot subscription confirmations

- Track which business purpose each item supports

TaxHakr will track and categorize these automatically so you don’t need a wall of shoebox receipts or a forensic accountant.

Why This Deduction Matters More Than You Think

Professional development is one of the most under-claimed deductions among 1099 workers.

Here’s why it’s powerful:

- You already spend the money

- It directly reduces your taxable income

- It compounds—better skills → better earnings → smarter deductions

Let the tools that make you better at your job also make April hurt less.

Quick Examples (Your Life, But Deductible)

Photographer

New lighting course? Deductible. Lightroom masterclass? Deductible. Subscription to a pro photo podcast? Deductible.

Real estate agent

CE credits, negotiation workshops, and real estate law updates: all deductible.

Crafter / Etsy seller

A course on improving product photos or pricing strategy? Deductible.

Content creator

Books on storytelling, courses on editing, paid newsletters about social media trends? Deductible.

Bottom Line

If it helps you do your current work better, smarter, faster, or more profitably, you should claim it.

Stop leaving money on the table. Your taxes should reward your growth—not punish your ambition.

TaxHakr makes sure you don’t miss deductions like this ever again.

Leave a Reply