Let’s get this out of the way first: If you’re making money on Etsy, it counts as taxable income.

Yes—even if it’s “just a side hustle.”

Yes—even if it’s “not that much.”

Yes—even if you didn’t get a tax form.

I know, I know. Etsy often starts as a creative outlet. A few candles here, some art prints there, maybe crochet hats or digital downloads. It doesn’t feel like a business. But the IRS doesn’t care how cozy your hobby feels, they care whether money changed hands.

“But It’s Not a Real Business… Right?”

This is one of the most common misconceptions I hear: “It’s just Etsy. I’m not a business owner.” Unfortunately, the IRS doesn’t define income based on how it feels.

If you:

- Sell physical products

- Sell digital downloads

- Take custom orders

- Receive tips or bonuses

- Get paid through Etsy Payments, PayPal, Stripe, or direct deposit

👉 That’s taxable income.

Even if:

- You only sold a few items

- You made under $1,000

- You never withdrew the money

- You reinvested everything back into supplies

Income is income when it’s earned, not when you decide it “counts.”

“But Etsy Didn’t Send Me a 1099…”

This one trips people up a lot. Just because you didn’t receive a 1099-K doesn’t mean the income is invisible.

Here’s the reality:

- Platforms report some sellers

- Banks report some deposits

- Payment processors share data

If your tax return says “$0” but Etsy says “$8,200,” guess who gets the follow-up letter? Spoiler: it’s not Etsy.

Hobby vs. Business: The Line Is Thinner Than You Think

People love to say, “It’s just a hobby.” Here’s the IRS version of that conversation:

Hobby income

- Still taxable

- Reported on your return

- No losses allowed

Business income

- Still taxable

- Reported on your return

- Expenses can be deducted

If you’re:

- Trying to make money

- Pricing items intentionally

- Marketing your shop

- Repeating sales year over year

You’re probably operating as a business, whether you meant to or not.

And here’s the twist most people miss: Reporting income properly is what unlocks deductions.

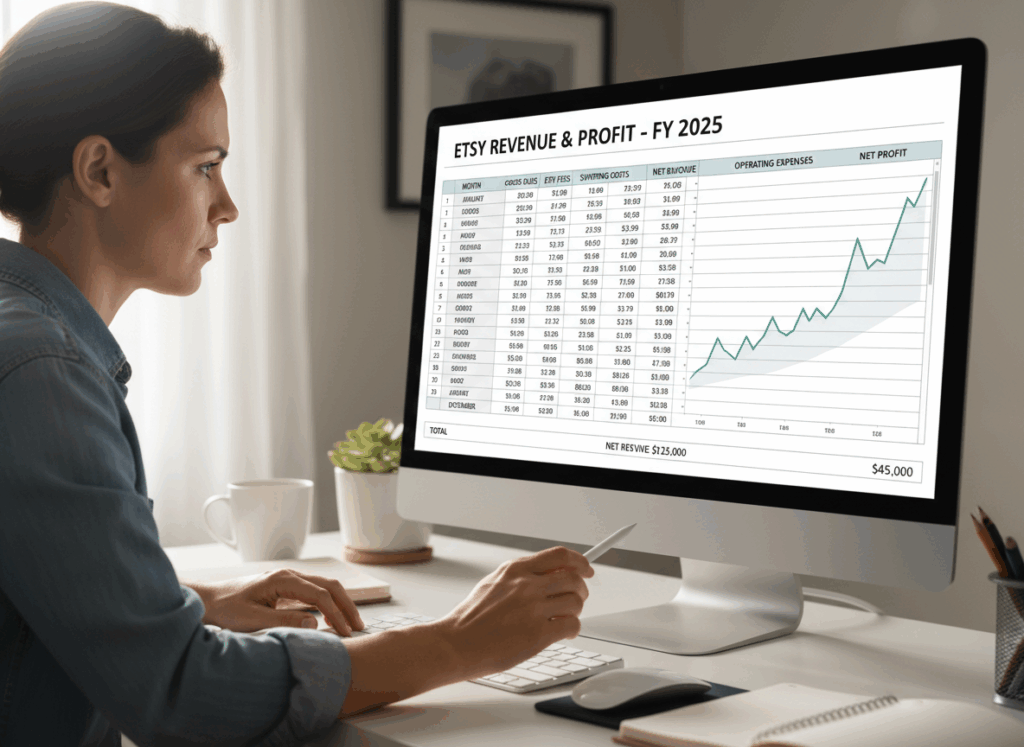

What Etsy Sellers Are Required to Report

At a minimum, Etsy sellers should be tracking:

- Gross sales (before Etsy fees)

- Shipping income

- Digital product sales

- Tips or bonuses

- Refunds and cancellations

- Fees and transaction costs

The IRS wants gross income first, expenses come after.

Skipping reporting because “fees ate it all anyway” is a fast track to an audit letter you don’t want.

The Risk of Not Reporting

Failing to report Etsy income can lead to:

- Back taxes

- Penalties

- Interest (it stacks fast)

- Amended returns

- Audit risk

But the bigger issue? You lose control.

When you report correctly, you tell the story. When you don’t, the IRS fills in the blanks, and they’re not generous.

The Smart Move: Report Everything, Deduct What’s Legit

Here’s the good news: Most Etsy sellers overpay taxes, not because Etsy is expensive, but because they’re not tracking deductions correctly.

Things many sellers can deduct:

- Supplies and materials

- Packaging and shipping costs

- Etsy fees

- Software and tools

- Part of your home or workspace (when eligible)

- Education, courses, and design tools

But none of that matters if the income isn’t reported properly first.

Bottom Line

If Etsy paid you, the IRS expects to hear about it.

Calling it “just a side hustle” doesn’t make the income disappear, it just makes the tax surprise bigger later.

The goal isn’t to pay more tax. The goal is to pay the right amount, with proof, protection, and peace of mind.

And trust me, future-you will thank you for handling it now instead of explaining it later.

Disclaimer

This content is for informational purposes only and does not constitute tax, legal, or financial advice. Tax laws and enforcement practices change, and individual situations vary. Always consult a qualified tax professional for advice specific to your situation.

Leave a Reply